India’s Solar Projections FY 2025-26 - Achievements, Challenges, and What Lies Ahead

FY 2024-25 saw some remarkable achievements in the Indian Solar Industry. This edition takes it a step further disecting the progress and what lies in the upcoming financial year.

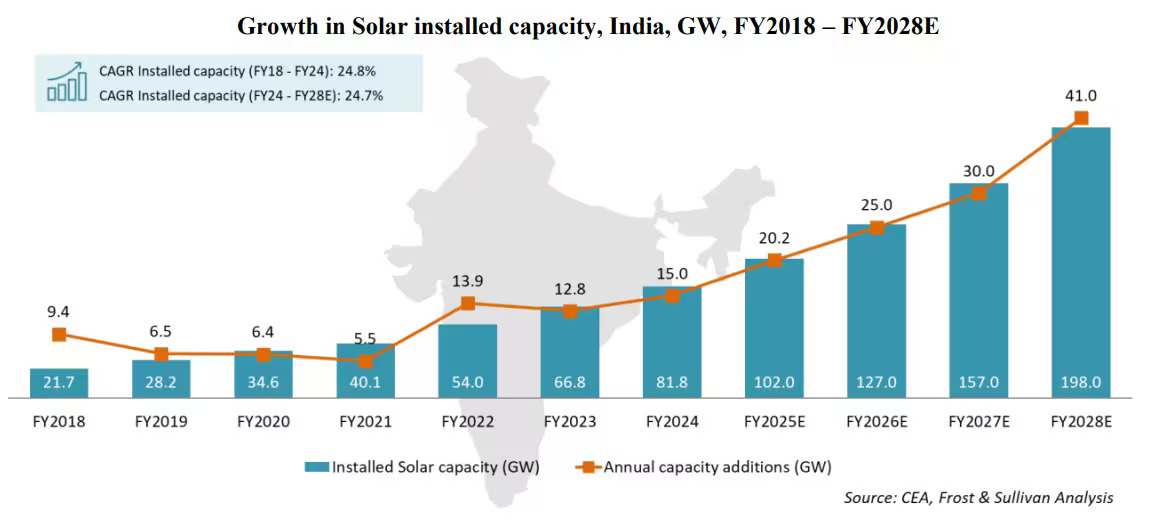

India has achieved a historic milestone by surpassing 100 GW of installed solar power capacity, reinforcing its position as a global leader in renewable energy. India’s solar power sector has witnessed an extraordinary 3450% increase in capacity over the past decade, rising from 2.82 GW in 2014 to 100 GW in 2025.

The rooftop solar sector in India witnessed remarkable growth in 2024, with 4.59 GW of new capacity installed, reflecting a 53% increase compared to 2023.

A key driver of this growth has been the PM Surya Ghar: Muft Bijli Yojana, launched in 2024, which is now nearing 9 lakh rooftop solar installations, enabling households across the country to embrace clean energy solutions.

But how did we get here? And what can we expect in the upcoming year? Let’s break it down.

Growth from 2018 to 2024

Between 2018 and 2024, solar rooftop capacity expanded from 2,538 MW to nearly 17,000 MW. The most rapid growth happened in the last two years, with capacity jumping from 10,221 MW in 2022 to 16,913 MW in 2024. This growth was supported by corporate sustainability goals, government incentives, and lower installation costs.

Residential solar installations saw a significant rise, growing from 503 MW in 2018 to 4,605 MW in 2024. Their market share increased from 19.82% to 27.23%, driven by subsidies like the PM Surya Ghar Muft Bijli Yojana and state-level incentives.

The commercial sector also expanded from 544 MW to 3,576 MW. Though its market share remained around 21%, many businesses chose solar to cut costs and meet sustainability goals.

The industrial sector remained the leader, growing from 1,088 MW to 8,733 MW. Its market share slightly declined from 42.87% to 51.63%, but it continued to dominate due to strong corporate commitments to clean energy.

How We Achieved This Growth

Government initiatives played a big role. The Central Financial Assistance (CFA) program covered up to 40% of installation costs for residential and institutional projects. Many states also offered extra subsidies, making solar more affordable.

The Approved List of Models and Manufacturers (ALMM) ensured high-quality installations by promoting domestic solar products. Additionally, the Production Linked Incentive (PLI) scheme boosted investments in local solar manufacturing, reducing dependence on imports.

The National Solar Mission significantly propelled growth, increasing installed capacity from 9.01 GW in 2016 to 97.86 GW in 2025. Additionally, schemes like PM-KUSUM and PM Surya Ghar Muft Bijli Yojana are accelerating solar adoption among farmers and households.

Financial models like CAPEX (Capital Expenditure) remained the most popular, accounting for 13,745 MW by June 2024. This model was favored for long-term savings and ownership. The OPEX (Operational Expenditure) model, where developers own and operate solar systems, held an 18.73% share.

Net metering policies further supported growth. They allowed consumers to sell surplus electricity to the grid. In states like Delhi, consumers earned ₹10.5 per kWh for their excess power, making solar a profitable choice.

Solar Projections for FY 2025-26

The future looks bright. India is expected to add 22 GW of solar capacity in FY 2025 and 27.5 GW in FY 2026.

Residential rooftop solar will grow further, especially with the PM Surya Ghar Muft Bijli Yojana providing free solar electricity to 10 million homes.

Domestic solar module production will reach 60 GW by 2025, supported by the PLI scheme. With over 67 GW of certified production capacity under the ALMM, India is reducing its reliance on imports.

Additionally, the PM-KUSUM scheme will continue empowering farmers with solar irrigation systems. With 10,000 MW of decentralized solar power plants and 3.5 million solarized pumps, the initiative will further contribute to capacity growth.

Challenges Ahead

Despite the progress, challenges remain. Import duties on solar modules and cells are high, with a 40% tariff on modules and 25% on cells. While this supports domestic manufacturing, it also raises project costs.

Financing is another challenge, especially for small-scale consumers. Although loans are available at rates as low as 6.5% from institutions like the State Bank of India, broader financial inclusion is needed.

The shortage of skilled labor is also a concern. Expanding training programs is essential to maintain installation momentum and ensure quality standards.

Net metering policies also vary across states, leading to inconsistent experiences for consumers. Harmonizing these policies can offer more clarity and encourage further adoption.

Conclusion

India’s solar journey is on a promising path. By leveraging government support, expanding local manufacturing, and fostering financial inclusion, the country is well-positioned to meet its ambitious solar targets.

The challenges are real, but with continued collaboration, we can illuminate a cleaner, greener future and build a sustainable future.

What is your projection for the upcoming financial year for the Indian Solar Industry?